Write Way Designs - TheOrdinaryJoe

Jobs & Careers at

Write Way Designs

Google+

Susana Rosende

Create Your Badge

(Your ad could

be here!)

(Your ad could

be here!)

(Your ad could

be here!)

(Your ad could

be here!)

The Ordinary Joe

The Ordinary Joe is about the average Joe, like Joe the Plumber.

It's also about the ordinary UNEMPLOYED Joe.

These days, everybody has a layoff story to tell. This page has tips for fighting city hall, writing an effective resume, and competing with countless unemployed Joes for the same job.

It is also the place for entrepreneurial tips for starting your own business, as well as for how to save and invest the money you earn, and for how to re-build your retirement fund. We will also post articles and tips for how to fight foreclosure, interview for jobs, save money, and survive on a shoestring budget!

Additionally, we'll have special fundraising and charity events to help our friends and neighbors in need, such as the fundraising effort to HELP SAVE A HOME.

Please click the following links for helpful articles

by Write Way Designs Writers

Susana Rosende and Sharon Manning!

- Top Job Interviewing Questions by Susana Rosende

- Fighting Foreclosure by Sharon Manning

- Foreclosure: What's it all about? by Sharon Manning

- Deed in Lieu, a Foreclosure Defense Strategy by Sharon Manning

- Loan Modification Programs by Sharon Manning

- The Short Sale by Sharon Manning

- Job Hunting Tips by Susana Rosende

- The Catch 22 by Susana Rosende

- Job Search Strategies by Susana Rosende

- Watch TV on the Internet to Save Money on Cable Bills by Susana Rosende

- Tips for How to Survive a Recession by Susana Rosende

- 25 Ways to Save on Groceries by Sharon Manning

- Unique Careers and Job Ideas by Susana Rosende

Top Job Interviewing Questions by Susana Rosende

You can never be too prepared for a job interview. Read the following questions and answers to help you prepare:

Tell me about yourself. This is your opportunity to give your elevator pitch in three minutes or less. It's business, not personal, so keep it professional. Do your homework first to know what the company or position requires. If it's technical knowledge, then play up your techie skills. If it's a management position, then talk about your leadership roles. Beforehand, write down two or three achievements and ensure to bring them up. This question is the perfect opportunity to do so.

What are your strengths and weaknesses? Everyone hates this question, right? Nobody wants to own up to weaknesses. The trick is to put a positive spin on it. First and foremost is to do your research. What does the position entail? If you are interviewing for a Human Resources position, stress your education and interpersonal skills. If you are interviewing with a startup company, emphasize your ability to multi-task, wear many hats, and be a self-starter. For a leadership role, tell about your most fulfilling Mentoring job.

When you speak of weaknesses, don't play it safe by saying what a perfectionist or workaholic you are. Everyone says that. Keep it real, but positive, because phoniness shines through. Instead, talk about your impatience (for getting things done) and time management issues (without showing incompetence by missing deadlines -- but by explaining the steps you took to beat this problem). That way, you not only come across as honest, but also as a problem solver!

What is your current salary? What salary range are you seeking? You don't have to answer this question, as the first interview is too soon to start a salary negotiation. Tell the employer that you are currently earning a competitive rate but would rather not discuss salary until you both feel that you are the right candidate for the job.

Why do you want to work for us? This question is one of the main reasons why you need to thoroughly research the organization before the interview. Read the company website, industry articles, company reviews, and speak to Linkedin.com contacts or to a current employee about the company culture. Be prepared to explain how the company and position fit your current professional goals.

Where do you see yourself in five years? Be prepared for this question and ensure you answer professionally. Don't mention anything personal like getting married, having a baby, or retirement! Likewise, don't mention anything overly aggressive such as that you want the interviewer's job, or even the CEO's. Speak of how you wish to continue on your path of professional growth with the organization.

Are you interviewing with other companies. Again, do not lie, because it will backfire, as this manager will probably have professional or social ties to a manager at the other company for which you are also interviewing, even, or especially if it's a competitor. Likewise, do not say you ARE interviewing with another firm when you are not. Just say you are keeping your options open for new opportunities.

Why should we hire you? Before the interview, search your mind for how you have best contributed to other companies in the past. Remember these examples and use them to show the steps you would take to achieve similar success at your new position.

How did you handle conflict in the past? Be careful with your answer. Do not discuss any problems you created or to which you contributed. Do not show any negativity or bitterness. Keep it positive. Talk about a problem that you were able to resolve at a previous job and focus on the resolution.

What is your passion? Again, keep it professional. Your interviewer is not looking to hear about your penchant for handgliding or for finding the best pickup lines for Saturday night. They want to know what you enjoy the most about your job or profession. If you are a technical writer, talk about the technology or industry you research to write manuals about. The interviewer wants to feel you are passionate about the job.

How do you handle stress? If the job for which you are interviewing involves life and death situations or is a fast-paced/heavy workload/deadline-oriented or extremely hyper-competitive environment, this question is valid. The job is stressful, and the interviewer needs to know if you can handle it. Again, keep it professional. Don't say, or even joke, that you plan to get hammered drunk or even hint at anything that can be considered a substance abuse issue. However, do mention healthy hobbies such as running, working out, Yoga, Art, Music, and/or meditation for ways you manage every day stress.

What do you do for fun? This may seem like a strange question to ask when the focus of the interview is on WORK. However, it is often a valid question in a very close-knit team environment. What is the company culture? Do co-workers spend a lot of time together after work for team-building purposes? Are you an interesting person outside the job? Will you join the division softball team? Does the team go to lunch together to brainstorm on projects or spend time together often, even with each other's families on weekends and evenings? Would you not fit in because you are a loner or a workaholic with the personality of a stone? The same goes for questions about whether you are an introvert or an extrovert. Will you fit with the team? Will your personality fit the job?

Why are you leaving your current employer? Be honest without being negative. State you are seeking professional growth. If you were laid off, mention that the company did some restructuring. In this day and age, there will be no raised eyebrows about being laid off.

Do you have any questions? Do not ask about salary and benefits or anything else that the company can do for you. Ask a few, personalized, well thought-out questions that demonstrate your focus on how you plan to contribute to the company.

For help on writing the resume that will get you the interview, click HERE to learn about our Resume Writing services.

Fighting Foreclosure by Sharon Manning

If you are like millions of Americans, your home is not worth the amount of the mortgage. You may be behind on your payments. The lender may have sent a foreclosure notice. You may have tried many avenues to keep your home. You may feel it's hopeless, but it is not. This article presents some options to think about.

If you are behind on your payments or know you are going to fall behind, it is key that you contact your lender as soon as possible and work out an arrangement for payment. This is your best bet for keeping your home. Please do not under any circumstances, make promises that you cannot keep, as it will only make things worse in the long run. If you are already in arrears or if repayment is not a viable option, read on.

Be aware that your lender is not always the agency that makes the final decision on your loan. There may be a servicer that owns the loan and makes the final decision. If unsure, click the helpful links below to learn who your servicer is and what to do next. If your lender is uncooperative, if you have questions that have not been answered, or if you just need mortgage assistance, there agencies listed in the following links that you can contact for information.

Consider the following options:

- Declaring bankruptcy can reduce your overall debt and increase your chances of paying on time. There are a number of consumer credit agencies to contact for help, as listed in the links below. Other options are to apply for a modification, to refinance your home, to sell your home in a short sale, or to give the lender your deed in lieu of payment. Please be aware that each of these methods have good and bad points and depending on the situation may or may not work. Researching each option before proceeding is the best idea.

- Hire a Foreclosure Defense Attorney. Fighting foreclosure in court is possible if the situation is viable. You must bring a defense of lender mistake or unconscionable action to file. If the case is won, the foreclosure will be stopped. Check back for articles regarding what are considered good defenses under these circumstances if you are interested in further information on this subject.

- If you or your co-signor are an Armed Forces or Coast Guard service member, you may be covered by the Service Members Civil Relief Act of 2003 or the SSCRA. Information and guidelines are available at the Department of Veteran's Affairs. See links at the end of this article.

Remember, the lender does not acrually want Foreclosure. Foreclosure costs a great deal of money and the lender's goal is to have a positive cash flow. The lender also wants his property to be occupied and at this time the market is awash with empty houses. These facts are a powerful weapon. Sometimes, if you can schedule a face-to-face appointment with the lender (a person able to make decisions regarding your account), you can speak to them about your ability to repay the loan, your commitment to the property, their cost with the foreclosure, the possibility of bankruptcy (which forestalls foreclosure), and any other strategies you may have lined up. You could also bring along a written plan of action showing how you would be willing to pay back the loan, at what rate, when, and at what payment. It could work for you if you have the ability to speak clearly and think on your feet. Communication is by far your most important ally in your fight to keep your home.

If you decide you need more help you can always seek advice from a professional. A Foreclosure Defense Attorney or Foreclosure Consultant can assist you with your mortgage problems (see links below). Be aware that the attorney will provide legal representation and information while a consultant will be able to assist in negotiating with your lender or in giving advice on refinancing your property, but in the latter situation always remember that this person is not a lawyer. Remember that you can always research for yourself, either via the web (see helpful links below), or at a law library which can be found at the local county courthouse, law school, or state capital.

Whatever decision you make, always get transactions in writing. Put any proposals you make on paper. Keep a log of telephone calls between you and the lender and/or servicer as well as any other agency involved with your case. Keep an online or email log as well. Put all your paperwork in a large binder or sturdy envelope so that it is available when you need it for quick reference. Include your original loan, any refinancing papers, budget worksheets, logs, a contact list with names, addresses, web sites, and phone numbers of anyone involved in your case along with copies of all letters received from the mortgage company. Make copies of all paperwork you send out and keep those in the file as well. Having the items on hand will save time and money later when you need them and help you in your fight to keep your home. Most importantly, don't give up and don't stop communicating. Keeping in contact with your lender's servicing department or servicer is the most important thing you can do toward staying in your home and getting through this time of crisis. Good luck and God Bless.

(EDITOR's NOTE by Susana Rosende: Also consider writing a letter to your congressman about your specific situation. Because it is an election year, your congressman is motivated to contact the mortgage company and intervene on your behalf.

(EDITOR's NOTE by Susana Rosende: Also consider writing a letter to your congressman about your specific situation. Because it is an election year, your congressman is motivated to contact the mortgage company and intervene on your behalf.

In my personal situation, I began payments again after being unemployed for 12 months and behind in payments for 5 1/2, but was sued for foreclosure after making payments for 18 months straight, and after my mortgage company had agreed that I was a viable candidate for a loan modification!

In addition to using a Foreclosure Defense Attorney for my case, I wrote a letter to my congressman. The combination of proof of employment, current salary, 20 years of home ownership at the address, legal assistance from a Foreclosure Defense Attorney, and letters to the mortgage company from my congressman, helped me get the loan modification to keep my home.

NEVER GIVE UP! But, most of all, don't sit back and wait for your home to be called for auction without a fight.

Act fast and you, too, may be able to stop foreclosure and save your home! Keep in constant communication with your mortgage company, as I did, including notifying them as soon as you become unemployed or have run out of savings and retirement money and can no longer make your payments. HIRE A FORECLOSURE DEFENSE ATTORNEY! If nothing else, a Foreclosure Defense Attorney can file motions to keep you in the home for at least 18 months while assisting with a Short Sale.

Personal thanks go to Congressman Daniel Webster, 8th District of Florida and Gregory & Clark Central Florida Foreclosure Defense Attorneys at

www.gregory-clark.com. Unlike other law firms that require a hefty retainer plus an additional hourly rate, Gregory and Clark charge a one time fee of under $3,000 ONLY for as long as it takes!

Additional thanks to son Joe, a high school senior at the time, who selflessly paid attorney fees from his college savings.)

For more options, click the following helpful links:

- The U.S. Department of Housing and Urban Development (HUD) at www.hud.gov or find your local department in the blue pages of your phone book.

- Neighborhood Assistance Corporation of America (NACA) at www.nacalynx.com/nacaWeb/index_main.aspx (on-line only) Restructures Loans

- Mers Foreclosure/Servicer Information Site at www.mersinc.org/homeowners/index.aspx

or 1-888-679-6377. For foreclosure, mortgage payoff amount, Servicer Name, and other useful information.

- Making Home Affordable at www.makinghomeaffordable.gov/get-assistance/explore-eligibility/Pages/eligibility.aspx Obama's remodification loan program 1-888-995-HOPE

- NOLO- On-Line Legal Encyclopedia with articles on all aspects of real estate law available for free. Complete with Lawyer Directory. www.nolo.com

- The Local Chapter of the Urban League at www.nul.org For (National)- Check the blue pages of Phone Directory.

- Credit Help- Consumer Credit Counseling at www.incharge.org 1-877-446-2249 or CCCS at www.cccsstl.org/ and 1-888-656-2227.

- Fannie Mae Loan Look-up at www.fanniemae.com/loanlookup/

and Freddy Mac Loan Look-up at ww3.freddiemac.com/corporate/

- AARP at www.aarp.org provides information about reverse mortgages and predatory lending.

- National Association of Consumer Bankruptcy Attorneys at www.naca.org for information and referrals to lawyers well versed in fighting foreclosure.

- Neighborworks at www.nw.org/network/index.asp for information on housing and remodification plans as well as foreclosure and scams.

- Society for the Preservation of Continued Homeowership at This is an excellent website for information about foreclosure and all your options. There are also a couple of books listed. I personally recommend “Fight Foreclosure” as it is full of information.

- HopeNow Alliance at www.hopenow.com has a list of Foreclosure Counselors on-line as well as a listing of servicers in the Obama remodification plan.

- National Council of State Housing Agencies at www.ncsha.org/ for Housing Assistance Programs.

- FHA LOAN information at or phone 1-800-CALL-FHA.

- Ginnie Mae Loans at www.ginniemae.gov/.

- Veteran's Affairs at www.va.gov/opa/ or at the HUD VA site at portal.hud.gov/hudportal/HUDsrc=/program_offices/comm_planning/veteran_information

- Find and read cases and court decisions at http://law.lexisnexis.com/shepards.

- National Conference of State Legislatures at www.ncsl.org/ or look up your state individually to find the current statutes and codes at www.westlaw.com.

- Also find cases at www.findlaw.com or www.hg.org.

(Editor's Note by Susana Rosende: Last, but not least, write your congressman about your specific case to see if he can intervene by contacting your mortgage company. Politicians are highly motivated to get votes during an election year and will be willing to help!)

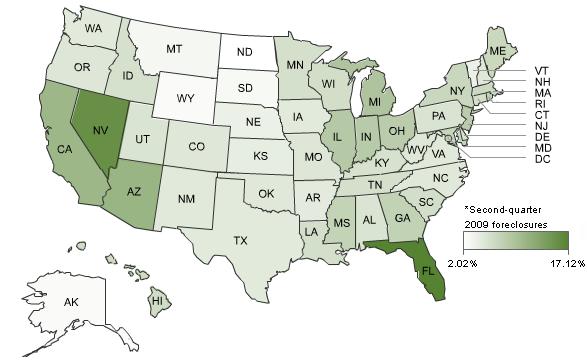

Foreclosure: What's it all about? by Sharon Manning

Foreclosure occurs when the borrower defaults on the mortgage payments, and the lender or its servicer utilizes state codes or statutes to evict the borrower and sell the property. Foreclosure can occur for other reasons such as failure to pay property taxes or insurance premiums or not complying with all the provisions settled upon within your mortgage loan agreement with the lender.

Foreclosure occurs when the borrower defaults on the mortgage payments, and the lender or its servicer utilizes state codes or statutes to evict the borrower and sell the property. Foreclosure can occur for other reasons such as failure to pay property taxes or insurance premiums or not complying with all the provisions settled upon within your mortgage loan agreement with the lender. Foreclosure proceedings happen differently depending on the state where you reside. There are two types of foreclosure: judicial and non-judicial. If you live in a state where the lender/servicer must file judicial, the company must file a lawsuit in order to foreclose, while a lawsuit is not needed in a non-judicial state.

JUDICIAL FORECLOSURE

The following is a list of Judicial Foreclosure States. There may be some exceptions, so always check your state statutes when in doubt.- Arizona*

- Delaware

- Florida

- Hawaii

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Nebraska

- New Jersey

- New Mexico*

- New York

- N. Dakota

- Ohio

- Oklahoma*

- Pennsylvania

- S. Carolina

- S. Dakota*

- Vermont*

- W. Virginia*

- Wisconsin*-Sometimes

The following is a 12 step Timeline for a Judicial Foreclosure:

- Complaint Filed- Lender begins the process by filing a Complaint in court due a loan default.

- Complaint Recorded- Lender gives county recorder notice of pending lawsuit, effectively preventing sale or refinancing.

- Answer Complaint- Within 30 days of #1, Borrower files and answer to Complaint. Prevents lender from obtaining default judgment and going to immediate Sheriff's Sale.

- Reinstatement period runs from the date lawsuit was filed until entry of judgment after the trial. This period gives the borrower a chance to bring the loan current.

- Discovery period runs from the date borrower answers Complaint until the case goes to trial. This time period is for collecting and exchanging evidence and documents, depositions and other procedures.

- The Trial occurs approximately two to three years after lawsuit was filed and a judgment will be entered at that time.

NOTE: If in Borrower's favor, the case is dismissed and the following does not apply. - Redemption period runs from the trial to the foreclosure sale. During this time the borrower may still stop the sale by paying off the entire loan plus costs.

- Writ of Sale and Notice of Levy- The Writ of Sale orders the Sheriff to sell your property according to the judgment instructions.

- Notice of Sale-Issued by the Sheriff to advise borrower when and where the property will be sold. Rules for notification are very specific depending on your state, so be sure to check them.

- Foreclosure/Sheriff's Sale occurs on the date listed on the notice via public auction. Buyer receives a Certificate of Sale and proceeds are distributed within a week.

- Deficiency Filing- If lender is going for deficiency judgment, must file application with same court within three months of foreclosure sale.

- Post-sale redemption period- Beginning the day of the sale and continuing for one year if lender is seeking deficiency or three months if lender is not, borrower may get property back by paying foreclosure sales price plus costs.

NON-JUDICIAL FORECLOSURE

The following list is of Non-Judicial Foreclosure States. There may be some exceptions, so always check your state statutes when in doubt.- Alabama

- Arizona*

- Arkansas

- California

- Colorado

- District of Columbia

- Georgia

- Idaho

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nevada

- New Hampshire

- New Mexico*

- N. Carolina

- Oklahoma*

- Oregon

- Rhode Island

- S. Dakota*

- Tennessee

- Texas

- Utah

- Vermont*

- Washington

- West Virginia*

- Wyoming *-Sometimes

In filing a lawsuit, you typically ask for a temporary restraining order (which lasts ten days), a preliminary injunction (which lasts until the case is over), and a permanent injunction (permanent and issued if the judge decides in your favor). Non-Judicial differs from the judicial in that the lender does not need to petition the court or file a lawsuit in order to sell your property. Unlike judicial proceedings, non-judicial foreclosures rarely involve having the lender pursue the borrower for any outstanding mortgage deficiency after a foreclosure sale is completed. The details regarding instituting foreclosure are usually available to the borrower on the deed of trust or note signed at closing of the original loan. The auction of property is conducted by a trustee who is authorized by your lender and must follow strict procedures beforehand.

The timetable for a non-judicial foreclosure is as follows:

- Notice of Default and Election to Sell- The trustee, upon lender request, records the default in public records, prepares this notice and mails it to the borrower and all others affected by the foreclosure (tenants, creditors, lien holders, contracted buyers) in notification of pending sale of the property. There are specific contents required on the Notice of Default (which may be one to two pages long). The trustee is under strict guidelines as to recording, mailing, posting and publishing the Notice to ensure that the borrower has ample legal notice of pending foreclosure. If any of the guidelines are not met, the borrower has a loophole for stopping the proceedings.

It is ironic, however, that there is no requirement that the borrower receive the actual notice of the proceedings. The foreclosure remains pending and valid as long as the trustee follows the guidelines to the letter regardless as to whether the notification was actually received by the borrower or not. Therefore, the borrower may wish to check carefully for the following items and record them when the Notice is received. If any of the items are missing, the borrower may wish to contact his attorney immediately to stop the sale.

a. Correct borrowers name (the trustor)

b. Book and page number in the county recorder's office where the deed of trust was recorded

c. Statement that the promissory note or deed of trust is in default.

d. Cursory description of your defaults, missed payments, delinquent property taxes and/or unpaid insurance.

e. Statement that the lender has elected to sell the property to satisfy the debt owed.

- Publish Notice of Default- In most states, the trustee publishes the Notice in a newspaper in the county where the property is located once a week or as required by the state until the sale. This should begin within days of recording the Default in the county records.

- Request Beneficiary Statement from Lender- The borrower, upon receipt of the Notice of Default, should send a written request for a Beneficiary Statement to the lender. The lender will then be aware that the borrower is concerned about saving the property from foreclosure and the borrower will have the added benefit of confirming the accuracy of the Notice of Default.

- Reinstatement Period- This period starts as soon as the Notice of Default is written and ends prior to the trustee's sale (per state law). The borrower can bring the loan current at any time during this period by paying the following:

a. The overdue principal, interest and late fees as stated in the Notice of Default.

b. The monthly payments due since the Notice was recorded.

c. The attorney fees incurred by the lender.

d. Any Tax or insurance prepaid by the lender.

e. PLUS the trustee's fees which are the cost of processing the foreclosure.

- The amounts increase daily, interest accrues, and the trustee incurs additional expenses as the foreclosure sale gets closer. To pay the loan, contact the trustee for the correct payoff amount as of a certain date. The borrower will need a cashier's check to take to the trustee's office in return for a receipt. If the office is not local, send the payment by certified or registered mail. The trustee will accept your payment if it is the correct amount and record a Notice of Rescission in the county recorder's office terminating the foreclosure. He will mail a copy of this Notice to you as well.

- Notice of Trustee's Sale- If you do not pay the loan current within your state laws period of time the trustee will issue a Notice of Sale. This Notice announces the date, time and location of the foreclosure sale of the property. This sale must be scheduled a specific period of days after the Notice of Trustee's Sale was issued (depending on local state law). Typically the sale is scheduled three to four weeks after the Notice of Sale is issued. Ironically, once again, this Notice remains valid regardless of whether or not you actually receive it. The trustee, however, must comply with specific procedures for the Notice to be valid. If not done correctly, the borrower can demand a new Notice of Sale.

- The Redemption Period- Depending on local state law the redemption period consists of the last days prior to the sale and ends when the bidding begins on sale day. During this period, the borrower no longer has the right to just bring the loan current. The borrower can redeem the property by payoff of the entire balance of the loan, plus late fees, penalties, attorney fees, and trustee's costs. If the borrower finds the means to pay the loan in full, he should make an appointment with the trustee to drop off a cashier's check for the correct amount and exchange it for a signed Full Reconveyance document. The Full Reconveyance document voids the deed of trust or note and cancels the foreclosure.

- The Trustee's Sale- If the borrower has not settled the debt by the date scheduled for the trustee's sale, a public auction will be held for the property. The sale must be held on a weekday between 9a.m. And 5p.m, in the county where the property is located, usually in front of the courthouse or another government building. While the borrower may want to miss the auction, it is advised that he be in attendance and take copious notes. Having a record of the event may give details that provide the ability to set aside the sale through a lawsuit if the sale does not go as it should. The trustee may also postpone the sale if there are no bids or for a variety of reasons. If he does, he must announce the postponement, why, and provide a new sale date.

- Overview of the Auction – All comers are allowed to bid at the auction, borrower included. To begin the sale, the trustee will announce that the property is for sale and describe the terms (all bids must be cash or cashier's check) including a description of the property as-is. The lender will make an opening bid followed by the trustee soliciting bids from the assembled group. The trustee is expected to keep the sale equitable and proper. The borrower should pay attention in case there are any irregularities in the process such as acceptance of money in exchange for not bidding, fixed bidding or restrained bidding as these items defraud the ability to get the highest price for the property and can negate the sale. The wrongdoer can be fined or imprisoned or both.

- Trustee Finalizes the Sale – The highest bidder receives a Trustee's Deed Upon Sale document which is recorded in the county recorder's office. This officially transfers the property title to the new owner. Within a week of the sale, the trustee will distribute the funds in the following manner:

a. The trustee receives reimbursement for costs and expenses.

b. The lender receives the sale proceeds up to the balance of the note, plus costs.

c. If there are any funds remaining, the junior lien holders receive funds in order of priority.

d. Any remaining funds are given to the borrower. (This is unlikely) - What Happens Next- The trustee prepares a settlement sheet detailing the distribution of the proceeds. The borrower should call or write for a copy as soon as possible. Errors have been made before, so check the addition carefully. Junior lien holders are eliminated by the trustee's sale as far as the new owner is concerned however, the original owner is liable for the amounts owed if they lien holders file a lawsuit to collect. Other lien situations unaffected by a trustee's sale include property tax liens and mechanic's liens for which the original owner remains liable.

- Buyer takes Possession of Property- Once the new owner receives the Trustee's Deed, they are entitled to take possession of the property immediately and the borrower is expected to move out. Some new owners may consider leasing the property, however, if this is not the case, be prepared to move. You will receive a Notice to Quit which states that you must move out withing three days. The new owner has the right to file an eviction action to have you removed.

- Currently there are approximately 8500 foreclosures in the United States every day. The only way to change that figure is to continue to fight. A judicial foreclosure can take anywhere from one to three years or longer to come to completion while a non-judicial foreclosure takes only two to four months or longer. During this critical time, the borrower can continue efforts to save the property from foreclosure by whatever means he deems appropriate whether with the help of an attorney or independently.

Check the Notice of Sale carefully for the following items:

a. The date of the sale is more than 20 calendar days after the Notice of Sale was Issued. (not received, issued)

b. It names a specific location where the sale will be conducted

c. The description of the property is the same as in the note, deed of trust, and Notice of Default (does not need street address, however)

d. The Notice must be mailed by certified or registered mail as well as by first class mail several weeks before the scheduled sale to the borrower and all others affected.

e. The Notice of Sale must be recorded at the county records office several weeks before the sale date though the exact deadline can be verified by checking the local state statute.

f. The Notice of Sale must be posted or displayed in a conspicuous place for notification of the public and any tenants of the pending sale several weeks in advance to the sale date. Posting is required in two locations- on your property and either at the city hall or the courthouse. The Courthouse or City hall can post the Notice on their bulletin board provided for notifications. The posting at the property should be placed either on the front door if possible or on a post or stake driven into the ground in the front yard of the property where it will be seen by people passing by.

If, as with the Notice of Default, you check the Notice of Sale and find any errors in procedure, the borrower can send a letter to the trustee demanding a new Notice be issued using proper guidelines per your state law which will stall the sale.

If, as with the Notice of Default, you check the Notice of Sale and find any errors in procedure, the borrower can send a letter to the trustee demanding a new Notice be issued using proper guidelines per your state law which will stall the sale. Please note that the timing with which you send the letter can give you more time if you wait until the last week before the sale to deliver the letter. Do not miss the deadline as the sale will go on.

Deed-in-Lieu, a Foreclosure Defense Strategy by Sharon Manning

A deed in lieu of foreclosure is a title-transferring document signed by the homeowner, notarized by a notary public, and recorded in the public records. It delivers the title from the homeowners to the bank/servicer that holds the mortgage.

If the borrower is unable to pay their mortgage payments and has exhausted all other options, they may be able to voluntarily turn the deed over to the lender in payment of the loan. This scenario usually occurs when the borrower is unable to qualify for loan modification because of too much income or not enough income. Normally, the option as to whether or not to accept the deed-in-Lieu is left up to the lender. Sometimes, the lender cannot accept the Deed-in-Lieu, as it is prohibited by a clause in the servicing guidelines. Sometimes, the lender or servicer, whichever actually holds the note, may expect the borrower to attempt to short sell the property first by listing it for a period of a specific number of days to be determined by the lender before they will consider accepting the offer of a Deed-in-Lieu. The lender or servicer may also have other specific conditions to be met. Acceptance of the deed in lieu ordinarily releases the borrower from all financial obligations of the loan.

This option can be looked upon favorably by the lender because the borrower is, essentially, handing over the keys. The lenders do not have to foreclose in order to retain the property, nor do they have to instigate legal proceedings to remove the tenants. The borrower leaves voluntarily and the lender can sell the property immediately. This option should be a last resort for the borrower. The borrower would only use this option if he is underwater on the loan and unable to make ends meet. The effect on the borrower's credit may be as severe as having done a foreclosure, which means not being able to finance another home for a period of approximately five to seven years.

To be sure of credit consequences, check with one of the three major credit reporting agencies prior to implementing this option. Contact www.equifax.com and 1-888-202-4025, or transunion.com and 1-800-888-4213, or www.experian.com and 1-888-397-3742.

There may be tax consequences for the borrower. With a deed in lieu, the lender may file a 1099C with the IRS for the deficiency amount (in equity) when the home sells. If it is a short sale, there is sure to be a deficiency. That amount is considered to be income or in this case, forgiven debt, on which you owe tax.

However, for loans secured on your primary residence during the years 2007, 2008 and 2009, you may exclude up to two million dollars in forgiven debt due to the new Mortgage Forgiveness Relief Act of 2007. If your loan is from a different year, you can claim legal insolvency at the time of the sale and avoid the taxes. In order to claim legal insolvency, your total debts must outweigh your total assets. This must be provable to the satisfaction of the IRS. For more information about this issue go to www.nolo.com and research the article, “Tax Consequences When A Creditor Writes Off A Debt,” or check the with your tax accountant or CPA.

Loan Modification Programs by Sharon Manning

A borrower with a home that is underwater or has negative equity, and is in arrears or even current on a mortgage loan can request that the loan be modified by the lender. This is not as easy as it sounds. Loan modification programs are available through the loan's original lender or a government agency and the final decision as to whether or not a modification is ultimately accepted lies with the lender/servicer of the loan. Modifications are time-consuming, frustrating, paper-generating machines that can drive a homeowner to distraction and result in absolutely no response from the lender other than a request for the exact same paperwork that has been submitted, repeatedly, for months on end. While I realize that some borrowers have had success with modifications, the overall majority have not. And most people feel that the government has failed to do enough to assist homeowners with this crisis.

As a person who is the midst of this crisis on a personal level, I can say that my family has been on the modification merry-go-round for almost three years with foreclosure looming in the near future. The bank/servicer in question has been uncooperative. We have enlisted the aid of two separate attorney firms with no results other than a loss of funds and a great amount of the same paperwork repeatedly generated. We know our Fed Ex delivery man by name and though he is a nice guy, dread the sight of him. We are currently waiting for a decision from underwriting (again). We went through NACA to file our latest attempt at modification and it has reached this stage. It has been at this impasse for over 8 weeks now and while we have been anxiously waiting for an answer, we were also served with conflicting paperwork stating the lender would be accelerating foreclosure, though they has not turned down the modification offer, and they continually request more paperwork. We have received the same foreclosure paperwork before.- actually two years ago.

I often wonder if the lender's office has a clue as to who is sending out what. Do yourself a favor and find either a foreclosure defense attorney or a consultant to represent your case. It makes everything less painful. NACA holds foreclosure workshops and can be found by visiting www.naca.com.

I often wonder if the lender's office has a clue as to who is sending out what. Do yourself a favor and find either a foreclosure defense attorney or a consultant to represent your case. It makes everything less painful. NACA holds foreclosure workshops and can be found by visiting www.naca.com.

There are several different types of loan modifications that a lender may qualify a borrower for including HAMP, MAP, FHA, Internal Modification Programs, HUD programs, HOPE, the new Hardest it Fund, and others. Modifications did not begin with President Obama's plan but were available prior to it. This recent crisis has simply brought them into the limelight. For more information about specific plans or questions go on the web at http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/nsc/nschome or call the National Servicing Center at HUD: 1-877-622-8525.

Below are the contacts numbers for some specific and Internal Loan Modification Assistance Programs

- Citigroup Homeowner's Assistance 1-800.667.8424.(If Current)

- 1-866.915.9417(Foreclosures)

- Countrywide Homeowner's Retention 1- 800.669.6650

- IndyMac FDIC Program 1- 800.781.7399 or 1-877.908.4357

- JP Morgan Chase & Co 1-866.550.5705

- FHFA Program 1-800-CALL-FHA

- HOPE Program 1-888-995-HOPE

(EDITOR'S NOTE FROM SUSANA ROSENDE: I, too, experienced the same runaround from Citimortgage, my home's lender. I highly recommend hiring a Foreclosure Defense Attorney and also writing your congressman about your specific situation to see if he can contact your Lender on your behalf.)

The Short Sale by Sharon Manning

A Short Sale is an alternative to foreclosure where the borrower enlists the services of a real estate agent/broker to list a property for sale and seeks to allow the lender to accept less than the full amount of the loan as full satisfaction of the loan. The lender may have specific conditions that must be met before agreement. There may be financial, credit and tax consequences that apply and should be investigated with a CPA, Tax attorney, Credit Bureau and/or Foreclosure Defense Attorney.

A Short Sale is an alternative to foreclosure where the borrower enlists the services of a real estate agent/broker to list a property for sale and seeks to allow the lender to accept less than the full amount of the loan as full satisfaction of the loan. The lender may have specific conditions that must be met before agreement. There may be financial, credit and tax consequences that apply and should be investigated with a CPA, Tax attorney, Credit Bureau and/or Foreclosure Defense Attorney.

If the borrower decides to attempt to sell the property in order to avoid foreclosure, they will require the services of a real estate agent that specializes in Short Sales. A short sale occurs when the lender agrees to allow the borrower to list and sell the property in order to settle the debt for less than the note amount. This can only happen if there is only one note and no other lien holders. Lenders will not agree if a property carries a second mortgage or has other liens as they will be assume responsible for those financial notes. A short sale is usually agreed upon when there is no equity in the home or the loan is upside down (or underwater).

The following specific requirements must be met for a Short Sale:

- Before agreeing to a short sale, the lender requires the borrower to submit a number of documents including: a letter of authorization, which lets your real estate agent speak to the bank/lender, a HUD-1 or preliminary net sheet, a completed financial statement, a hardship letter, two years of tax returns with W-'s, recent payroll stubs, the last two months of bank statements, and a comparative market analysis or list of recent comparable sales (for assistance in pricing the property).

- Second, the Buyer will want to get a good deal on the property, possibly at slightly below market value or with some added incentives as he will probably have to wait for closing for a few months as is usual with short sales.

- Third, the Buyer's Agent will be looking at the listing carefully as short sales are not high on the list of transactions due to the lowered commissions earned. The listing needs to be worded in a way that shows the property to the best advantage, and include numerous photographs (photos will help sell the property).

- Fourth, the Buyer's Lender will want the property to appraise within comparable market value. Being on the low side will not be a problem but if priced too high, the property will not appraise within restrictions and the Buyer's loan will not go through.

- Last, the Seller, or the original borrower, will want to get as much for the property as humanly possible as to offset any possible equity deficiency judgement that the bank/lender may decide to report to the IRS after the sale. That deficiency can be considered as income by the IRS if the bank/lender files a 1099C for the deficit.

In order to price a short sale correctly, the amount needs to be attractive to a number of entities. This can be a difficult task but is possible with a short sale real estate agent that knows the marketplace. First and foremost, the borrower must satisfy the Lender with the proposed sale price. It needs to be comparable to the current market in order to sell within the allotted time frame and therefore avoid the foreclosure on the property or the borrower will have wasted the lender's time and his own.

If the real estate agent finds a buyer, the buyer will need to submit a short sale offer to the seller (original borrower) for acceptance. Once the seller accepts the offer, the listing agent sends a package to the lender/bank which includes the following documents: the listing agreement, the executed purchase offer, the Buyer's preapproval letter and a copy of his earnest money check, and the seller's short sale package. If the package is not complete, the short sale will be delayed. The bank might even shred the paperwork. Just because the seller has accepted the offer does not mean the lender/bank will.

Then the wait begins. Buyers often cancel because of the long wait due to the process at the bank. The short sale process at the bank involves numerous steps. First, the bank acknowledges receipt of the file. This can take 10 days to a month. Then, a negotiator is assigned within 30 to 60 days. Next, a BPO is ordered. The bank probably will refuse to share the results of the Broker Price Opinion. Following this a second negotiator may be assigned (possibly another 30 days). The file is then sent for review or to the Pooling Servicer's Agreement, which can take another two weeks to 30 days. After which, the bank may then request that all parties sign an Arms-Length Affidavit (see end of this article for definition). Finally, the bank issues a short sale approval letter.

When you consider that the entire process at the bank can take up to 120 days, it's really no wonder that real estate agents don't want to work with short sales for smaller commissions or that buyers cancel prior to the completion of the sale. It is imperative that you have a short sale real estate agent handling the sale for you, and that they have proven experience in the field, as their experience will make the process go more smoothly. They will know to check with the bank often during this process as paperwork can get lost or misplaced and phone calls misdirected.

With a short sale, your real estate agent may request that the property holder (borrower) make numerous repairs before listing the property in order to prepare it for sale. The property must also be kept in sale ready condition while it is listed. Once the sale is completed, the original borrower will receive no income whatsoever. Any repairs, painting or installations done in preparation are costs that will not be recovered by the borrower after the closing.

The borrower must also be made aware that the lender may insist on a continued obligation to the remaining debt if the short sale does not pay off the existing loan. They are agreeing to release the lien on the property for less than what they are owed so that the borrower may sell it. They are still able to request an unsecured note be signed for the deficiency between amounts collected in the sale and the loan amount. The borrower can end up without a home and in debt for thousands of dollars unrecovered by the short sale. So prior to listing a short sale, find out what the lender plans to do regarding any deficiency in the event of a sale, and remember to get all agreements in writing.

To top it off, the short sale, like the foreclosure, will put a negative mark on your credit report. The amount of points dropped off your FICO score will depend on how far in arrears you are in payments more than the short sale itself. For more information regarding the impact of a short sale on your credit log contact www.equifax.com or call 1-888-202-4025 or contact www.transunion.com or call 1-800-888-4213 or www.experian.com or call 1-888-397-3742.

To top it off, the short sale, like the foreclosure, will put a negative mark on your credit report. The amount of points dropped off your FICO score will depend on how far in arrears you are in payments more than the short sale itself. For more information regarding the impact of a short sale on your credit log contact www.equifax.com or call 1-888-202-4025 or contact www.transunion.com or call 1-800-888-4213 or www.experian.com or call 1-888-397-3742. On the plus side, after a short sale you do not have to wait five to seven years in order to purchase another home as in with a foreclosure. Depending on how far you are in arrears, you may be able to purchase a new home very quickly. At the very least, you can get a new loan within two years even with the worst possible report from a short sale. Recently, a borrower with a short sale who was current on his payments financed a new home after two months with Flagstar Bank. FHA has adopted new guidelines regarding bouncing back after short sales, recently, as well. So while short sales can be a difficult, lengthy and time-consuming process where the borrower must weigh all the options carefully prior to a decision to go forward, there is financial recovery to look forward to.

Job Hunting Tips by Susana Rosende

No job is ever really permanent or guaranteed these days, and so it's important to keep abreast of hiring trends and practices in the job market. To make sure you are Resume-and-Interview Ready, click the following links from Careerbuilder.com for some worthwhile tips:- Five Ways to Turn Off Employers

- How Your Job Search is Like Selling a Home

- Four Ways to Get a Hiring Manager's Attention

- Are you Shooting Too Low in Your Job Search?

- 10 Hiring Manager Deal Breakers

- The Best Way to Conduct a Mediocre Job Search

The Catch 22 by Susana Rosende

There's a disturbing trend in current hiring practices. Not only is unemployment still at an all-time high, but employers such as Sony, many recruiters, and many job posters on Cragslist are now including the following requirements in their ads: "No Unemployed Candidates Will Be Considered At All," "Client will not consider/review anyone NOT currently employed regardless of the reason," and "Must be currently employed," as if it weren't bad enough that all companies were doing credit checks on candidates, disregarding the impact of unemployment and foreclosure on credit ratings since 2008.

There's a disturbing trend in current hiring practices. Not only is unemployment still at an all-time high, but employers such as Sony, many recruiters, and many job posters on Cragslist are now including the following requirements in their ads: "No Unemployed Candidates Will Be Considered At All," "Client will not consider/review anyone NOT currently employed regardless of the reason," and "Must be currently employed," as if it weren't bad enough that all companies were doing credit checks on candidates, disregarding the impact of unemployment and foreclosure on credit ratings since 2008.

Apparently, there is no acknowledging the effect of the recession on highly qualified candidates, many of whom are now part of the long-term unemployed (46 percent of the current unemployed population). It would appear that companies are willing to steal talent away from their competitors intead of hiring the equally talented folks who are currently in the market. A better stance would be to resolve to hiring ONLY THE UNEMPLOYED.

Yet, even government officials, including Senator Judd Gregg, are putting the onus on the unemployed; this, despite the fact that our nation is still in a jobs recession, despite the temporary census jobs. More than 29 million Americans are still without work or forced into part-time work, making it a real jobless rate of 16.6 percent. Nearly 7 million people have been jobless for over 26 weeks (hence, the term "long-term unemployed") -- more than any other time since the Great Depression. To reach full-employment, we still need more than 22 million new jobs.

Everyone seems to forget that Wall Street was the real cause of the current Recession, not the hapless unemployed. In any case, never before has the phrase, "it's better to look for a job while you still have one," ever resonated as powerfully.

Everyone seems to forget that Wall Street was the real cause of the current Recession, not the hapless unemployed. In any case, never before has the phrase, "it's better to look for a job while you still have one," ever resonated as powerfully.

For more on this disturbing phenonmenon, click the following links:

- Disturbing Job Ads: 'The Unemployed Will Not Be Considered'

- Long-Term Unemployed Now 46 Percent of Unemployed, Highest Percentage on Record

- Are the Unemployed Causing Unemployment?

- Poverty Rate Climbs in Recession: One in Seven is NOW POOR!

- For the Unemployed Over 50, Fears of Never Working Again

Job Search Strategies by Susana Rosende

For articles on job search strategies, see the following links:- Aggressive Job Search Strategies for a Difficult Market How Can Domino's New Pizza Recipe Help You in Your Job Search?

- Best Interview Preparation For Medical Device Sales Reps

- How Cufflinks Create a Good Impression on Job Interviews

- Staffing Firms - Towards a Positive Future

- Job Interviews - Always a Runner-Up, Never the Winner? Can't Close the Deal?

- Tips on Responding to Job Advertisements

- Do You Have Job Interviewing Skills?

- Saving Time in Your Job Search is Easier Than You Think

- How to Give the Perfect Answer to Every Interview Question You'll Ever Be Asked

- Don't Become a "Patsy" to Job Search Schemes

- Online Classified Ads Are a Great Source For Job Seekers

- Is Job Search Success Eluding You? 3 Steps To The Right New Job

- Job Hunting Myths - Things That You Should Never Believe

- Give Yourself a Break! Good Interview Follow-Up Begins While You're Still at the Interview

- What You Must Do to Land a Job in a Hyper-Competitive Market

Watch TV on the Internet to Save Money on Cable Bills by Susana Rosende

An easy way to save money is to cancel Cable TV and watch television on the Internet, and that doesn't just mean to watchYou Tube. There are free Internet sites that allow access to major networks for FREE! Just imagine having NO MORE CABLE BILLS!

An easy way to save money is to cancel Cable TV and watch television on the Internet, and that doesn't just mean to watchYou Tube. There are free Internet sites that allow access to major networks for FREE! Just imagine having NO MORE CABLE BILLS!

Click the following links to learn more about these Internet options today:- Hulu -- for shows from major networks, including Fox, ABC and NBC.

- Joost -- for free films and cartoons

- Boxee.tv -- for major network content and Netflix

Enjoy!

Also, click More tips on how to increase frugality by giving up items you can live without.

Tips for How to Survive a Recession by Susana Rosende

- 168 Frugal Tips for Making Your Money Stretch

- Seven Tips for Recession-Proof Budgeting for Tough Times

- Scott Rafer’s Survival Tips from 2000

- Getting the American Dream in a Recession

25 Ways to Save on Groceries by Sharon Manning

Shopping for groceries has become a marathon event. With the introduction

of the superstore, picking up a few groceries is no longer simple. Navigating

your way through a weekly food budget is tricky. Saving money on food for a

family of four is a challenge. Even the most savvy shopper needs a few money

saving tips.

Shopping for groceries has become a marathon event. With the introduction

of the superstore, picking up a few groceries is no longer simple. Navigating

your way through a weekly food budget is tricky. Saving money on food for a

family of four is a challenge. Even the most savvy shopper needs a few money

saving tips.

- Always shop with a list. Stick to the list and don't deviate from it. It will keep you from overspending.

- Always shop alone. Leave the kids and the significant other at home. You will have fewer distractions and be able to calculate prices and deals.

- Beware of sale and bulk items as they may not be the deals that they seem to be. Compare them by weight and price for the best deal. Manufacturers often pay retailers to display certain items as special sales. Bulk items can be deceptive. The only way tobe sure is to do the math.

- Before shopping check the local ads for your favorite grocery, pharmacy and retail stores to compare prices. By doing this often you will learn which store has the best price on what items and where the best sales will run. Don't forget your local farmers market. It is a great place to buy your produce. Purchase some sale items from a retail store if you shop there regularly. Most toiletries are best purchased at either a retail store or pharmacy, so check ads for the best option. At the grocery store, you should only buy groceries.

- When shopping at the grocery store- shop the perimeter first. The store is organized with staple foods around the perimeter (milk, eggs, cheese, deli). The more costly aisles of prepackaged foods are usually at the center of the store. When in the aisles, look up or bend down- the most expensive items are placed at eye level.

- Cut coupons from your newspaper or search for them on-line and match them with the advertised sales. Plan your menus around the ads and the coupons in order to save more money.

- Attach your coupons to your grocery list so that you do not forget them. Nothing is worse than getting to the checkout and realizing that you have left the coupons at home.

- Join customer loyalty programs at your favorite stores. They do save you money. They may also send you coupons or allow you to earn points towards rewards.

- Watch for in-store coupons. Many stores offer coupons on a display in front of the shelf.Take an extra for next time.

- Do not shop when you are hungry or tired. You will just buy more food.

- Do not be afraid to ask for a raincheck or a price match. Most stores will give a raincheck on an out of stock sale item. Many stores offer a price match to another store's sale price if you bring in their ad.

- Take advantage of Buy One Get One frees (BOGOs) as often as possible, especially if you have a coupon! This is like free money. Double check the deal if the BOGO is on packages of meat. Some stores mark the price up to compensate.

- Buy store brands when possible. Do the math, if you have a coupon and want to buy a name brand. Generics work well in most recipes.

- Take a calculator with you so you can compare unit pricing. This is the only way to know you are getting the best deal. Divide the price by number of units.

- If you are just running in to get a couple of items, ditch the cart. It will keep you from buying too much. You can also walk to the store, or bike. If you can't carry it, you won't buy it.

- Make one trip to the store, not several. Every trip you make is an opportunity to overspend. You are not only avoiding temptation, you are saving on gas.

- Buy meat in larger packages and break it up for use in multiple meals. (if it is a savings).

- Avoid convenience packaging. Those small packages may seem like a great deal but they are not cost effective. Do the math. This is especially true of frozen vegetables and cookies.

- Have a plan for leftovers. Don't waste food.

- Don't buy more than you need. Just because an item is on sale as a two-fer does not mean that you have to buy two. You can buy just one at the sale price in most cases. Check the store policy.

- If every time you go to the store you buy the same magazine, subscribe to it. It'll save you a lot of money.

- The most important thing to remember when shopping is to get in, get what is on the list and leave-without any extras. If you can do that, you will have used your coupons, saved money and finished your shopping as planned.

- Pay attention at the checkout. Watch the scanner. At some stores if the item does not ring up correctly, it is free.

- Remember to use your coupons.

- Check your receipt before leaving the store. Checkers are not infallible and mistakes happen.

Websites for Coupons

- www.printablecouponsanddeals.com

- www.couponcaboodle.com

- www.couponmom.com/

- www.moneysavercouponsonline.com

- www.couponalbum.com

- www.dailygrocerycoupon.com

- www.thegrocerygame.com

- www.coolsavings.com

- www.coupons.com/

- www.couponcabin.com

- www.shopathome.com

- www.couponnetwork.com

- www.couponmountain.com

- www.couponsurfer.com/

- www.redplum.com/

- www.i-coupons.com/

- www.kroger.com>

- www.publix.com/save

- www.winndixie.com/coupons/coupons.asp

- www.foodlion.com/Savings/Coupons

- www.wholefoodsmarket.com/

- www.albertsons.com/

- www.pigglywiggly.com/

(Editor's Note by Susana Rosende:

(Editor's Note by Susana Rosende:

For neighborhoods known as Food Deserts, where there is low-vehicle ownership and no easy access to healthy food, the Virtual Supermarket Program (VSP) is a new, innovative program for making food available.

This program allows neighborhood residents to order food from their public libraries. Payment is accepted in cash, credit, debit, and EBT/SNAP (food stamps) for easy access to food without the need to take multiple bus rides or taxis. It is the only program nationally that allows for online food ordering and accepts SNAP. Click The Virtual Supermarket Project to read more about it.)

Unique Career and Job Ideas by Susana Rosende

For unique careers and job ideas, see the following:- Five Ways to Get Rich Without a Single Discernible Skill

- Eight Weird Jobs

- 37 Weird Jobs

- 121 Jobs That Don't Suck!

- Cool, Unique, and Seasonal Jobs

- The Seven Best Jobs for Facebook Addicts

- The Quintessential Career

- Best Job for Lazy Bones

- Best Five Jobs in the World

- Best Careers for 2012

- Build Your Business Via Twitter

Help Save A Home

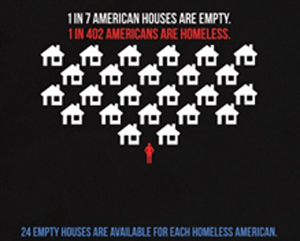

This economy has negatively impacted so many families, individuals, and businesses. So many today are unemployed and underemployed, and the lack of funds is heavily impacting our society's most vulnerable.

The biggest question facing us today is often "What else can we live without?" Businesses cut their benefits; families cut out cable, eating out, dance lessons, the second car. But some folks find themselves burning the candle at both ends to no avail. And as they find themselves facing foreclosure and needing to couch surf wtih friends and family, they often find themselves having to make the heartwrenching decision to give away their most trusted companion -- the family dog.

Pet lovers can attest to how much love and companionship a dog (or cat) can bring. If truth be said, nobody loves you like a dog. But, in today's economy, losing one's home most often means losing one's dog, too. Man's best friend often finds himself at the pound, and man, without his best friend when he needs him the most.

Multiple pet households often face the heartwrenching fate of having to decide who to keep and who to leave behind, and how can one choose between one's furry children? As pet lovers can attest, pets are not only trusted and loved companions, but also part of the family.

One family, in particular, lives with five dogs. Each and everyone of them has a story of how it came to join the family. Each has its unique personality and its "favorite person," too! Most have been members of the family for over a decade. For all of them, this is the only home they've ever known, and the family is in the midst of fighting foreclosure.

So, we ask for your help. Please donate what you can, even $1 can go a long way toward helping with dog food, and vet bills, and even with legal fees as this family fights to keep their home and canine children together forever.

Please click the image below to donate. Please help this family keep their canine "kids"!

Please click image below. Thank you for your generosity.

STAY TUNED! Coming soon from Write Way Designs to a browser near you (at www.theordinaryjoe.com)!

Copyright 1997-2019

288,988 Visitors

www.writewaydesigns.com | susana@writewaydesigns.com | 1-407-670-9554

Susana Rosende, President of Write Way Designs, Executive Director of Communications, Senior Staff Technical Writer, Technical Editor, Marketing Copywriter, Content Strategist, Creative Author, Translator (English/Spanish), Illustrator, Photographer, Painter, Cartoonist, Designer.

susana@writewaydesigns.com and Susana.Rosende@gmail.com | 1-407-670-9554